Once upon a time, you’d pay back a friend by fishing a crisp $5 out of your wallet. These days, more and more Americans say they don’t carry cash, with about 3 in 10 adults saying they make no cash purchases in the average week.

Technology makes it easier than ever to be a cashless member of society, and the right app can let you send payments to friends, family, and clients with just a few taps. But as we jump into the increasingly crowded online space of mobile payments, you may start to wonder...what’s the safest way to pay online?

Fortunately, the vast majority of mobile apps are dedicated to protecting their users’ private information— but here are some of the best and safest options to try.

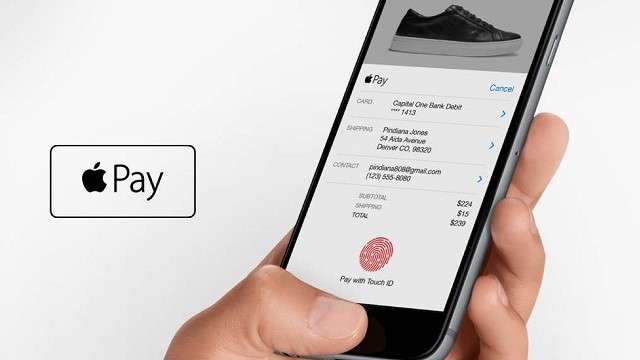

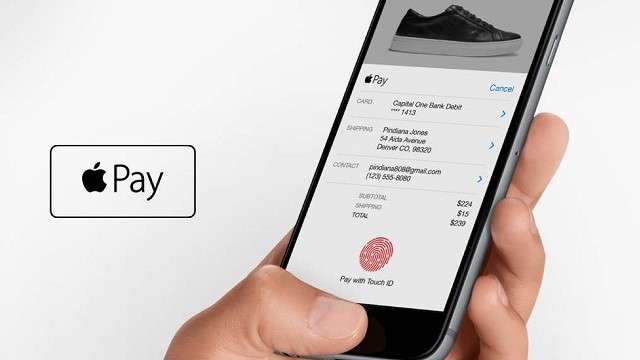

Apple first announced Apple Pay back in 2014. Today, the app available in over 17 countries and comes pre-installed on new Apple devices, though it’s still good to know how to set Apple Pay if you’re new to the software.

You can store your credit card or debit card information within the app, or you can load cash directly from your bank account. There are no fees if you pay with a debit card, or if you're transferring money to another Apple pay user. However, using a credit card incurs a 3% transaction fee.

It’s very safe to use, as the app itself is password-protected, and you can also lock it through fingerprint scans or facial recognition software.

Google Pay is part of the Google Suite of products, so if you have a Gmail account you already have access to Google Play. This makes it easy to send money to your existing contacts via email using Google pay. As the dominant email service worldwide, it’s a good payment option if you want to send money to virtually anyone!

To make it even more convenient, you can even connect your PayPal account to your Google pay account. Google Pay does not charge transaction fees for debit cards or for Bank transfers, but if you use a credit card you’ll incur a fee of 2.9%.

Read Also: Top 10 Free Online Plagiarism Checker Tools

Since 1998, we've trusted this global powerhouse to take care of our online transactions—and it’s just as visible a brand today as it was then.

This tried-and-tested option may be the best payment app if you want to be able to pay a huge range of users, especially since there are over 288 million active accounts. PayPal doesn't charge fees if you are sending money to friends or family, but you will be charged if you need to convert to a foreign currency or if you're sending cash from a credit card.

Next safest way to pay online is through Venmo. Venmo is a new and popular option for anyone who needs frequent mobile payments. Owned by PayPal, Venmo differs from other options because it’s primarily a phone with certain social media features as well.

The app allows you to split purchases and checks between multiple people, make payments via Siri and iMessage, and pay via Paypal.

Read Also: Top 10 Best Wireless CCTV System for Home

Zelle is mostly used for person-to-person transfers that come straight from your bank. it's a little bare-bones compared to other options on this list, but it’s convenient in the right situation.

The advantage of this payment service is that you can make same-day transfers when you and your recipient both have an account at a participating bank. These banks include Bank of America, Chase, Citibank, Wells Fargo, Ally, and Capital One. In addition, there are no fees for sending or receiving money, and you don't need to install an app on your phone.

With over 2.5 billion users, Facebook is already a global giant, so if you’re wondering how to send money online to friends and family, this is a good option.

The transaction process is straightforward, as you and your recipient simply need to have a debit card connected with your account. From there, all payment information is private, so all your recipient will see is your basic account info, including your name and your profile picture.

Read Also: Top 10 Cheapest Drone With Longest Flight Time

Formerly called Square Cash, the Cash App is compatible with both Android and iOS devices. You can begin carrying out your transaction by linking a bank account or by using a credit or debit card.

It’s most often used by businesses and consumers, as it lets recipients get their money within minutes. For senders, fees are 3%, and you’ll also be charged 1.5% for instant bank transfers.

Samsung pay is another mobile brand that has gotten into the money transfer game as well. As with Apple Pay, you can only transfer money between two Samsung users. This means you might have access to fewer users than Apple pay if you're trying to transfer money to a wide range of people.

However, Samsung Pay is convenient to use, as you can tap your phone to pay at participating points-of-sale as well as some types of magnetic stripe readers.

Read Also: Top 10 Best Budget 4K TV For Gaming

Another safest way to pay online is Circle Pay. Based in Boston, Circle Pay is available for use in 29 countries around the world, and it accepts dollars, pounds, and euros. It's a great option for international transfer, as it does not charge extra fees or markups.

You can make your payments instantly in a secure way. However, you need to keep in mind that your bank may still charge a fee.

Another online payment app owned by PayPal, Xoom lets you send money to people and up to 66 countries. The recipient does not need to have the Xoom app but they do need to have a PayPal account.

Although it works on both Apple and Android phones, it does not currently support online or in-store purchases, so you'll only be able to send money between people.

For More: Technology

Whether you’re sending money to business overseas or splitting the check with a friend sitting across from you, they’re a great way to make it happen with a touch of convenience.

For more information on the best of technology, check out our other posts!

Technology makes it easier than ever to be a cashless member of society, and the right app can let you send payments to friends, family, and clients with just a few taps. But as we jump into the increasingly crowded online space of mobile payments, you may start to wonder...what’s the safest way to pay online?

Fortunately, the vast majority of mobile apps are dedicated to protecting their users’ private information— but here are some of the best and safest options to try.

Context

- Safest Way to Pay Online

- Apple Pay

- Google Pay

- PayPal

- Venmo

- Zelle

- Facebook Messenger

- Cash App

- Samsung Pay

- Circle Pay

- Xoom

- Conclusion

Safest Way to Pay Online

1. Apple Pay

Apple first announced Apple Pay back in 2014. Today, the app available in over 17 countries and comes pre-installed on new Apple devices, though it’s still good to know how to set Apple Pay if you’re new to the software.

You can store your credit card or debit card information within the app, or you can load cash directly from your bank account. There are no fees if you pay with a debit card, or if you're transferring money to another Apple pay user. However, using a credit card incurs a 3% transaction fee.

It’s very safe to use, as the app itself is password-protected, and you can also lock it through fingerprint scans or facial recognition software.

2. Google Pay

Google Pay is part of the Google Suite of products, so if you have a Gmail account you already have access to Google Play. This makes it easy to send money to your existing contacts via email using Google pay. As the dominant email service worldwide, it’s a good payment option if you want to send money to virtually anyone!

To make it even more convenient, you can even connect your PayPal account to your Google pay account. Google Pay does not charge transaction fees for debit cards or for Bank transfers, but if you use a credit card you’ll incur a fee of 2.9%.

Read Also: Top 10 Free Online Plagiarism Checker Tools

3. PayPal

Since 1998, we've trusted this global powerhouse to take care of our online transactions—and it’s just as visible a brand today as it was then.

This tried-and-tested option may be the best payment app if you want to be able to pay a huge range of users, especially since there are over 288 million active accounts. PayPal doesn't charge fees if you are sending money to friends or family, but you will be charged if you need to convert to a foreign currency or if you're sending cash from a credit card.

4. Venmo

Next safest way to pay online is through Venmo. Venmo is a new and popular option for anyone who needs frequent mobile payments. Owned by PayPal, Venmo differs from other options because it’s primarily a phone with certain social media features as well.

The app allows you to split purchases and checks between multiple people, make payments via Siri and iMessage, and pay via Paypal.

Read Also: Top 10 Best Wireless CCTV System for Home

5. Zelle

Zelle is mostly used for person-to-person transfers that come straight from your bank. it's a little bare-bones compared to other options on this list, but it’s convenient in the right situation.

The advantage of this payment service is that you can make same-day transfers when you and your recipient both have an account at a participating bank. These banks include Bank of America, Chase, Citibank, Wells Fargo, Ally, and Capital One. In addition, there are no fees for sending or receiving money, and you don't need to install an app on your phone.

6. Facebook Messenger

With over 2.5 billion users, Facebook is already a global giant, so if you’re wondering how to send money online to friends and family, this is a good option.

The transaction process is straightforward, as you and your recipient simply need to have a debit card connected with your account. From there, all payment information is private, so all your recipient will see is your basic account info, including your name and your profile picture.

Read Also: Top 10 Cheapest Drone With Longest Flight Time

7. Cash App

Formerly called Square Cash, the Cash App is compatible with both Android and iOS devices. You can begin carrying out your transaction by linking a bank account or by using a credit or debit card.

It’s most often used by businesses and consumers, as it lets recipients get their money within minutes. For senders, fees are 3%, and you’ll also be charged 1.5% for instant bank transfers.

8. Samsung Pay

Samsung pay is another mobile brand that has gotten into the money transfer game as well. As with Apple Pay, you can only transfer money between two Samsung users. This means you might have access to fewer users than Apple pay if you're trying to transfer money to a wide range of people.

However, Samsung Pay is convenient to use, as you can tap your phone to pay at participating points-of-sale as well as some types of magnetic stripe readers.

Read Also: Top 10 Best Budget 4K TV For Gaming

9. Circle Pay

Another safest way to pay online is Circle Pay. Based in Boston, Circle Pay is available for use in 29 countries around the world, and it accepts dollars, pounds, and euros. It's a great option for international transfer, as it does not charge extra fees or markups.

You can make your payments instantly in a secure way. However, you need to keep in mind that your bank may still charge a fee.

10. Xoom

Another online payment app owned by PayPal, Xoom lets you send money to people and up to 66 countries. The recipient does not need to have the Xoom app but they do need to have a PayPal account.

Although it works on both Apple and Android phones, it does not currently support online or in-store purchases, so you'll only be able to send money between people.

For More: Technology

Conclusion

These Apps Are the Safest Way to Pay Online. The encryption and security features within these mobile transaction apps make them the safest way to pay online.Whether you’re sending money to business overseas or splitting the check with a friend sitting across from you, they’re a great way to make it happen with a touch of convenience.

For more information on the best of technology, check out our other posts!